DUBLIN 2, Ireland, 23-Oct-2018 — /ERP FOOD & BEVERAGE NEWS/ — A recent study by Fact.MR on the Europe cocoa market brings interesting insights to the fore. The comprehensive report by Fact.MR tracks cocoa production and consumption across key European markets. The report is available for direct purchase, however, a sample of the report has been made available by Fact.MR at

https://www.factmr.com/connectus/sample?flag=S&rep_id=44

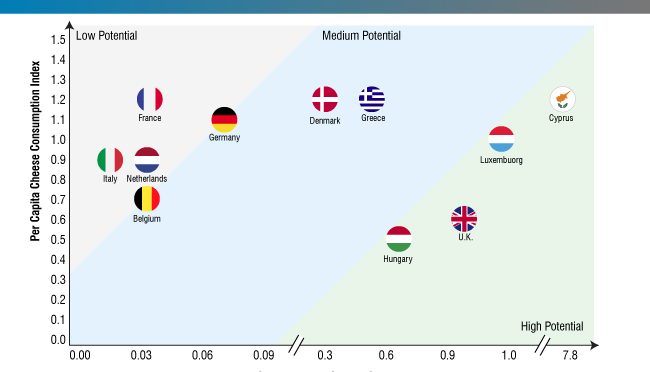

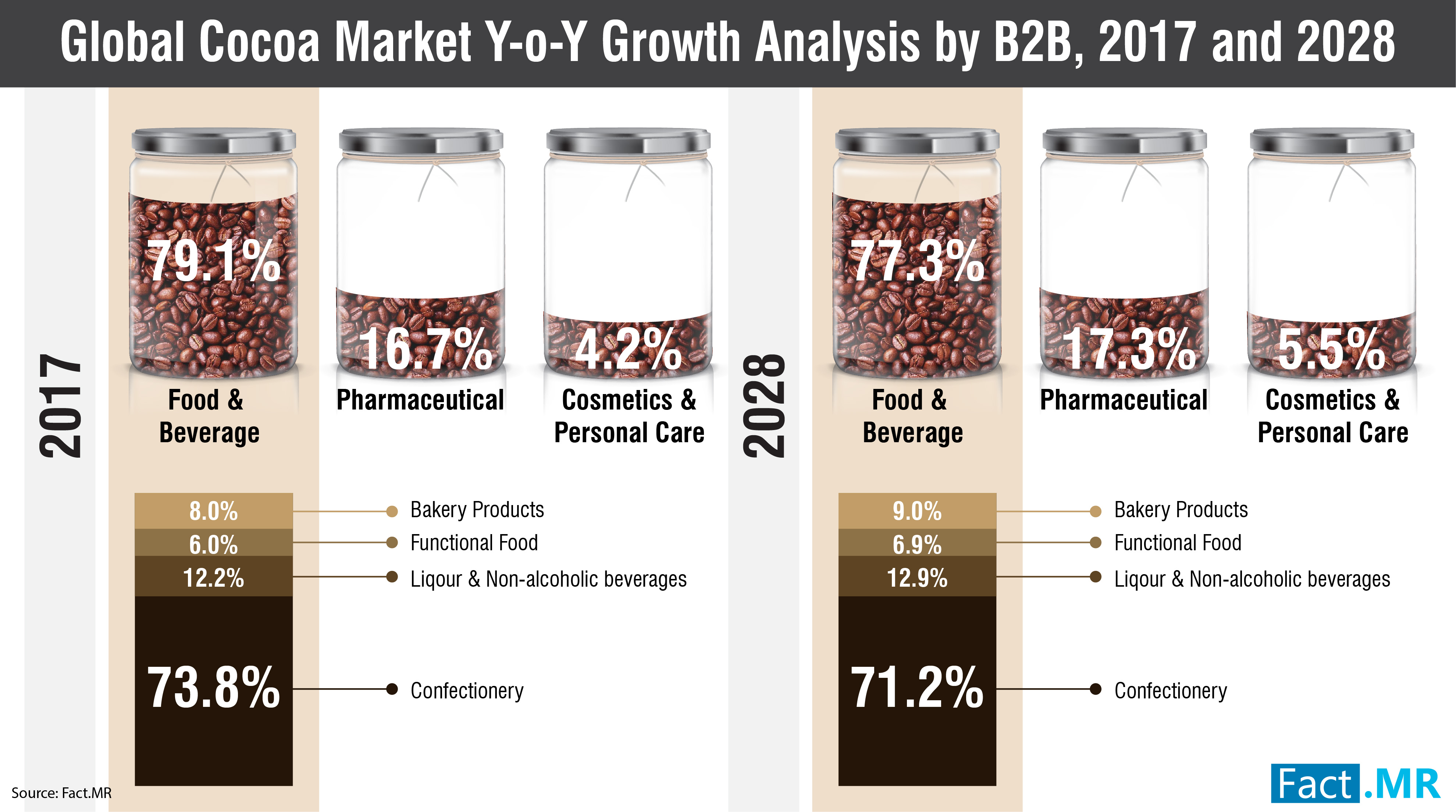

According to the report, Europe stands as the largest cocoa beans consumer – way ahead of North America and Asia-Pacific regions. Europe has seven of the top ten chocolate consuming countries in terms of per capita. Netherlands, France, Belgium, and Germany are the key importers as well as consumers of cocoa. While food and beverages remains the key sector using cocoa, the demand is also growing in pharmaceutical, cosmetics, and personal care industry.

Cocoa Powder Outsells Butter and Liquor Variants

The Fact.MR study opines that cocoa powder demand has been growing at a faster pace in the region, over cocoa butter and cocoa liquor. Fact.MR estimates that cocoa supply has been in surplus in Europe since past several years, owing to a straight growth in demand. The stakeholders in the European cocoa market most importantly the manufacturers of finished products, are gauzing the consumer sentiments well, and hence keeping their inventory levels satiated.

The comprehensive study is available for direct purchase, get your copy now at https://www.factmr.com/checkout/44/S

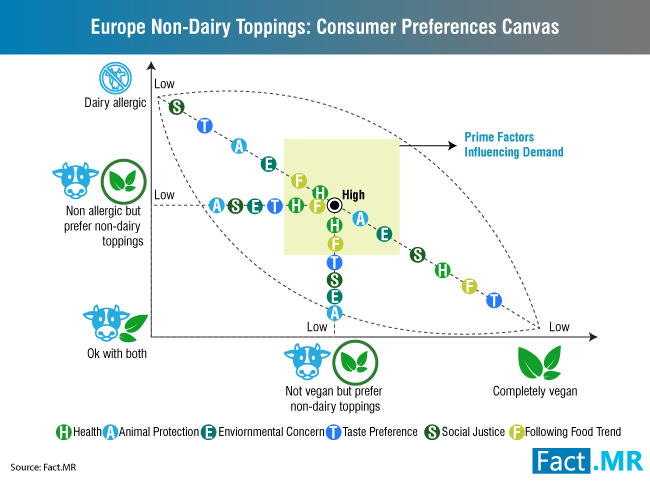

One of the key factors driving the European cocoa consumption is the blend of tradition and innovation in the cocoa products processing. Europeans prefer chocolate in the form of both bars and drinks. European consumers are not only concerned about their intrinsic health, but also have a great concern for their skin. This factor has kept aloft the demand for cocoa butter in the European cosmetics industry. Because cocoa is edible and its taste is liked by the European masses, its application in lip balms is not uncommon. Besides, the European cosmetics companies are also increasing the number of their products such as body lotions and facial creams having cocoa as an ingredient.

European drug shelves crowd a range of nutraceutical and health supplement products with cocoa. Chocolate is one of the most identical flavor to European neutraceutical consumers, due to which the demand of cocoa in this industry. The research works on cocoa has stated the favorable impact of cocoa in the cardio-metabolic diseases, which motivates the European medical advisors and consultants to encourage their customers and clients to use cocoa based pharmaceutical products. These factors are likely to provide an impetus to the growth of Europe cocoa market.

Besides, individual fondness of cocoa, there are several activities that further aggravates the interest levels of stakeholders in this industry. Food and beverages trade fairs in Europe are one of the prime drivers of cocoa demand in the region. Finland is one of key countries organizing such events, which includes Wine, Food & Good Living, e-Commerce and Shop Tech, and Gastro Helsinki. In Wine, Foods & Good Living exhibition, there are significant number of stands for beverages cocoa. The e-Commerce and Shop Tech exhibition trade fair brings the industry stakeholders at a common place to web a mesh of planning heads. Gastro Helsinki is a trade fair that focuses on bringing hotels, restaurants, and catering industries on a discussion platform. Some of the other trade fairs and events promoting cocoa and chocolate in Europe include Salon du Chocolat (France), Intersuc (France), Sial (France), Chocoa Trade Fair (Netherlands), Eurochocolate (Italy), and BioFach (Germany). These events have helped rejuvenated the interest and thus demand for cocoa and cocoa products in the region.

About the Report

Fact.MR’s report on cocoa market offers a pragmatic and comprehensive analysis that are influencing demand and supply in Europe and beyond. The research study tracks the consumption and production of cocoa in Europe. An in-depth analysis on the product and business strategies of key players has been included in the research study.

SOURCE: EuropaWire